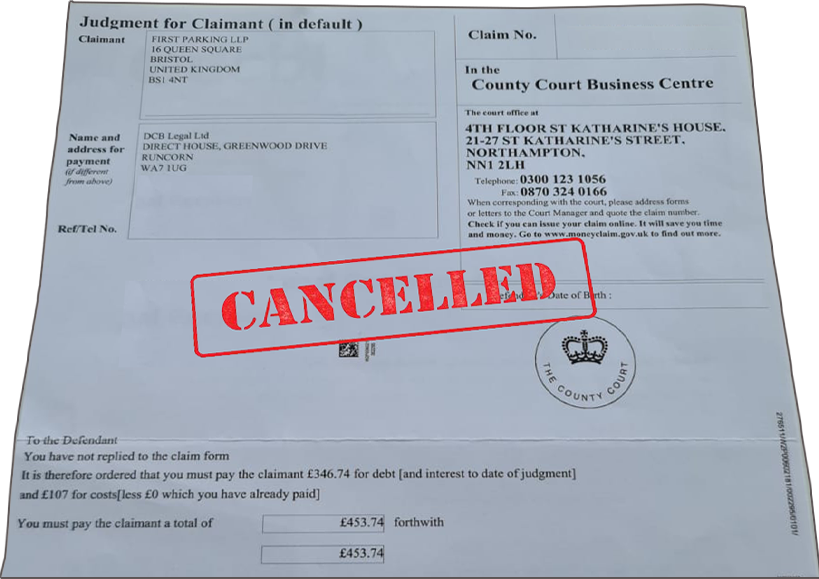

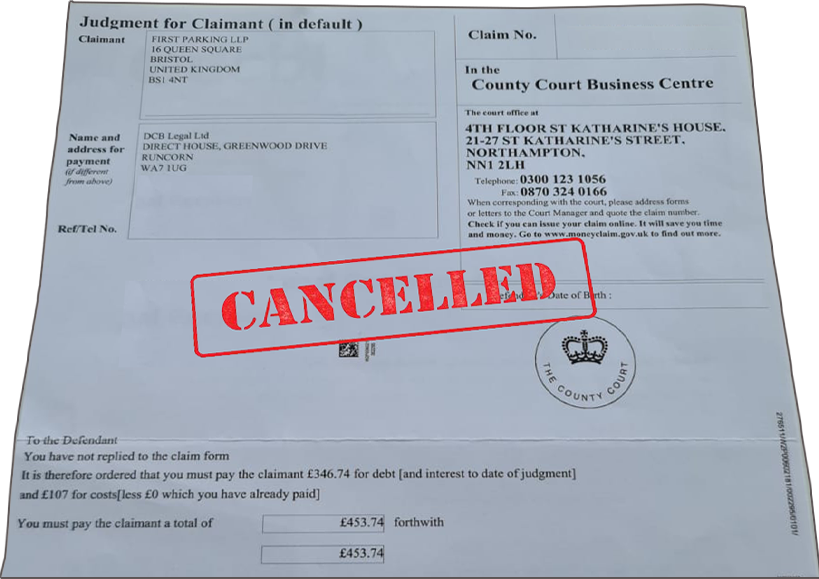

For Us..it's as easy as 1, 2, 3. If we can't cancel your CCJ nobody can!

Let's Get Started..

We are the UKs No1 Court Claim Dispute Experts, with Hundreds of Happy Customers!

Let's Get Started..

If you’ve received a County Court Judgment, it can stop you from obtaining credit, such as a mortgage, loans or even a mobile phone contract.

Furthermore, it may even stop you from getting some types of jobs if it’s not removed from your credit record.

Most people are not aware of receiving a CCJ as they either moved address, were away from home at the time the claim was issued and only discover when they apply for some type of credit.

If this is you then we can help. We pride ourselves on providing excellent customer service. Our independent reviews

speak for themselves and we look into each and every case with the aim to win!.

Our helpline allows you to speak to an expert and get guidance on

the phone regarding anything related to your CCJ problem. There isn't much

we don't know about this subject area.

If you prefer you can use our ticket check page and once we have started working on your case you can keep track online through your own online portal.

A County Court Judgement (CCJ) is a judgment against you for a debt you have not paid. Either because you did not respond to the court papers that were sent to you (Default Judgement) or you disputed the case and lost, and did not pay the amount owing within the specified time given by the court.

If the Judgment sum is not paid within the period specified in the County Court Judgment (which is usually within one month of the date of the Judgment in the case of Default Judgments) a CCJ will be entered on your credit record at the Register of Judgments, Orders and Fines and will remain for six years.

The only 3 ways to remove a CCJ are either:

Yes, a judgement that has been paid after the 1 month period will still stay on your credit file however it will show as being "Satisfied" (i.e. no monies are owing) rather than "Unsatisfied"

There are two way to obtain a Court Order to set aside:

Any application made to the court must be supported by evidence. This evidence should establish the actual basis for the application; this evidence may include:

Our service includes:

No, we are not a Solicitors or Barristers. Therefore, in providing any services to you we are not acting as a Solicitor or Barrister and we are not subject to many of the rules which regulate practising solicitors or barristers and we cannot represent you in any Court without the express permission of the Court.

However, we are able to assist you and guide you through the Court process and help you complete Court documents.

Our track records speaks for itself and customer service is our number 1 goal. You are able to contact us via phone, Email, WhatsApp, Telegram or Text message and we aim to provide you with excellent service.

The Legal Ombudsman, which can adjudicate on complaints about poor service by practising Barristers and Solicitors, cannot consider any complaint against us because we are not Barristers and Solicitors.

To get CCJ information you will need the Claim number (this is normally on your credit file) - If it is not then you will need to contact the Claimant (person/company you owe money to listed on your credit file) to get the Claim number. Once you have this, contact the County Court Business Centre on 0300 123 1056 who will be able to provide the Claimant name, date of registration and other relevant information

You can also check if a Claim number has a County Court Judgement registered against it by visiting TrustOnline - https://search.trustonline.org.uk/Search/CaseNumber

We have specialised in Parking Appeals for many years assisting hundreds of clients during that time to get CCJs removed. However we can help with most CCJs including Utility bill such as gas, electricity and water services, mobile phone and outstanding debt recovery.

We have a fixed one time admin fee of £249 for CCJ removals. Please note that there are separate court fees payable.

In addition to our admin fee, the court cost of setting aside the judgment will depend on whether the claimant is willing to consent to judgment being set aside or whether an Court application needs to be made to set it aside.

If we can't beat your

parking ticket or CCJ, nobody can.

Use the online check

to see what we can do.

We handle your dispute

from start to finish.

The online portals shows

the status of your case.